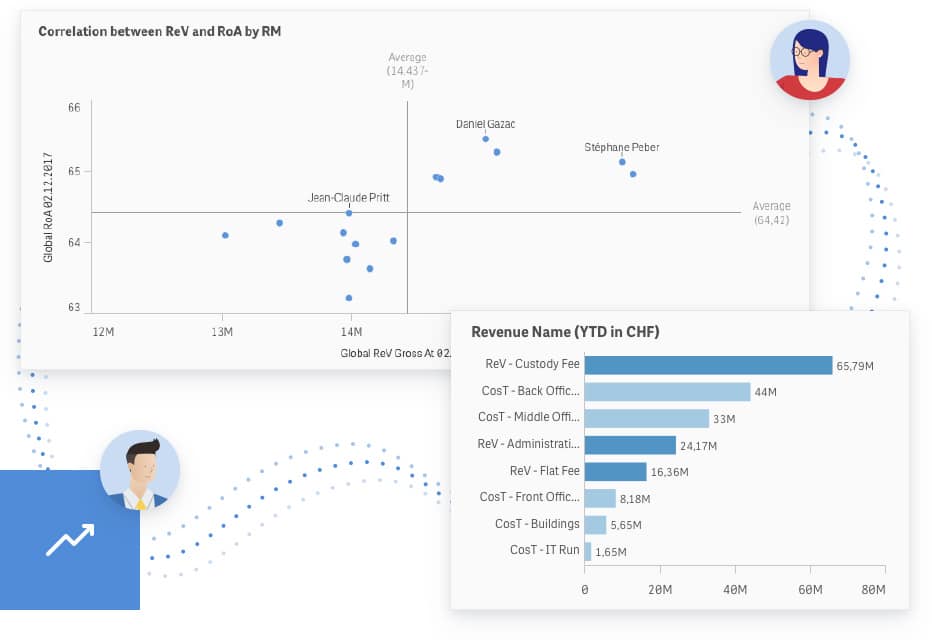

Data quality is essential

Data is the result of our operational processes: it highlights our strengths and weaknesses. We shouldn’t expect data to be perfect – it probably never will be – but we should pay particular attention to key data that has a major impact on the organization. A data culture cannot be improvised; it has to be built up over time, and requires a strong impetus from the management teams.